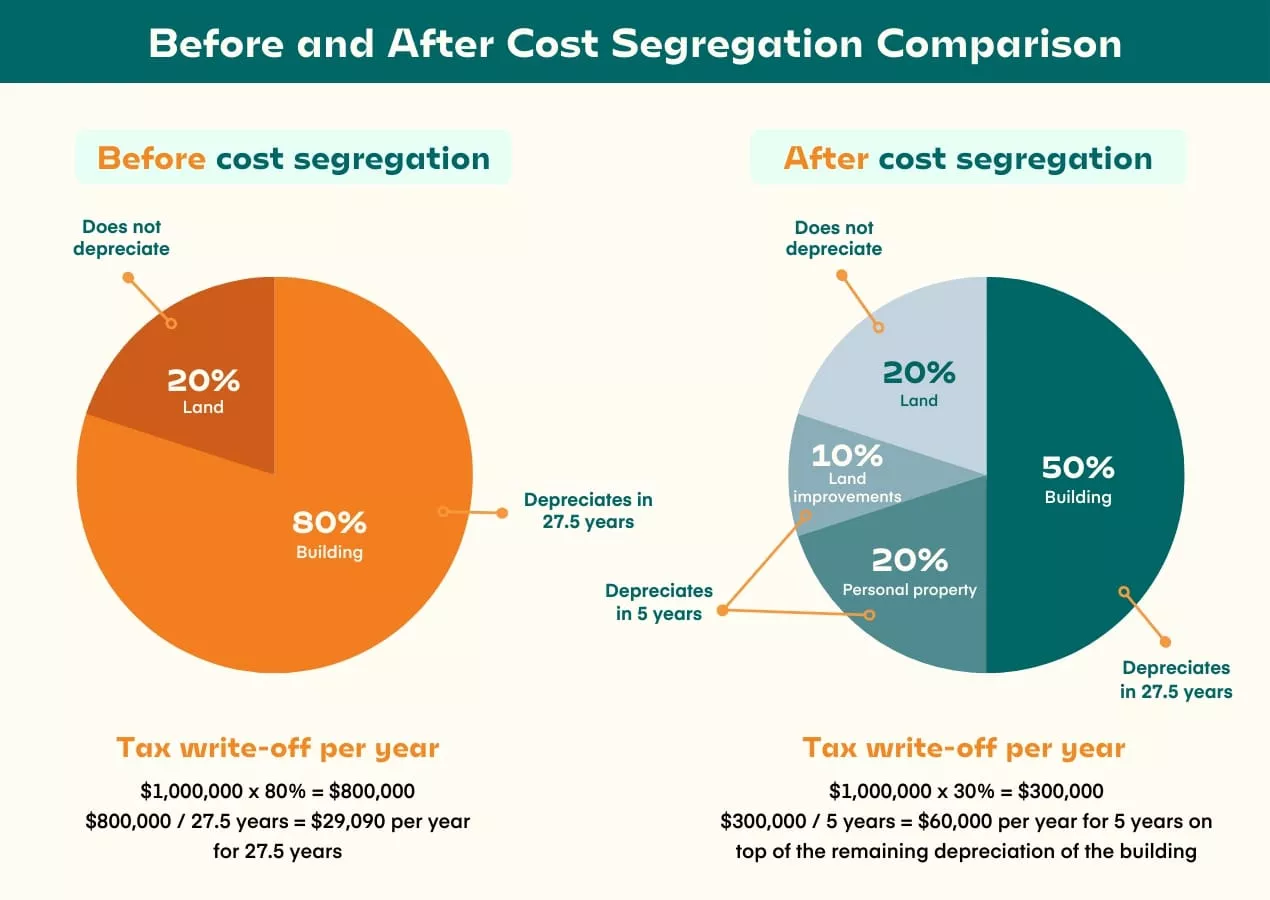

Commercial property owners can accelerate depreciation and reduce the amount of taxes owed by obtaining a Cost Segregation Study. Depreciation is an income tax claim that real estate investors can use to help recover the cost of owning, operating and maintaining that property each year. Cost Segregation Studies reduce the amount owed on income taxes by separating assets into categories which depreciate at quicker speeds than real property.. This in turn reduces the expenses of owning investment real estate and can allow for other investments or purchases due to increased cash flow.

The same year after you buy, build or remodel a property is an optimal time to obtain a Cost Segregation Study. But, if you did not perform a Cost Segregation Study when you first built, purchased or remodeled a property, you can order a look-back study and claim a catch-up tax deduction. This catch-up tax deduction could be claimed in a single tax year. The Internal Revenue Service continues to develop its own guidelines for understanding and auditing returns that claim depreciation under these rules that favor the commercial property owner. Especially because “catch-up” depreciation is available to property owners who purchased commercial property after 1987, it appears that Uncle Sam, in this case, is on the side of the taxpayer.

Cost Segregation is a way for real estate investors to more quickly deduct the depreciation of a property against their taxable income. This program is based on the Investment Tax Credit, and can mean a savings of more than 20% on taxes for the depreciation of the non-permanent, non-structural assets of their commercial investments. Cost Segregation allows you to speed up the depreciation schedule, increasing the amount you can deduct each year. The current rate of depreciation for real commercial property is 39 years. The purpose of a Cost Segregation study, then, is to separate the personal property assets from the real property assets so that, under IRS guidelines, the depreciation of certain qualifying assets can be accelerated to 5, 7 or 15 years instead.

Contact us now for more detailed information on a Cost Segregation Study for your investment properties.